Wednesday, December 25, 2013

2014 Iran Becomes Good Guy/Saudi Arabia Becomes Bad Guy

Let's watch what happens as the "West" recasts the bad guy role.

Monday, December 23, 2013

Gold and Gresham's Law

|

| COMEX Registered Gold 12/20/2013 |

Really, Gresham's law is about price controls on commodities, and "price control" is all about reconciling a number, i.e. an idea, with reality. Reality stubbornly slips through any attempt to bind it in an inky net.

Gold is an alternate store of value to contractual devices, like dollars, stocks, or bonds. "Money", is really a way to organize (or bind) people's time and energy and thoughts. People's agreement to be bound to the system is what makes a dollar valuable. Prices are currently attached to precious metals through markets that are easily manipulated by the beneficiaries of the monetary system, but the mass of people, especially in Asia stubbornly refuses to believe that numbers are valuable.

What happens when the USD denominated gold market breaks? That's a pretty huge glitch in the matrix.

What happens when the USD denominated gold market breaks? That's a pretty huge glitch in the matrix.Thursday, December 12, 2013

Is Our World Really This Stupid?

|

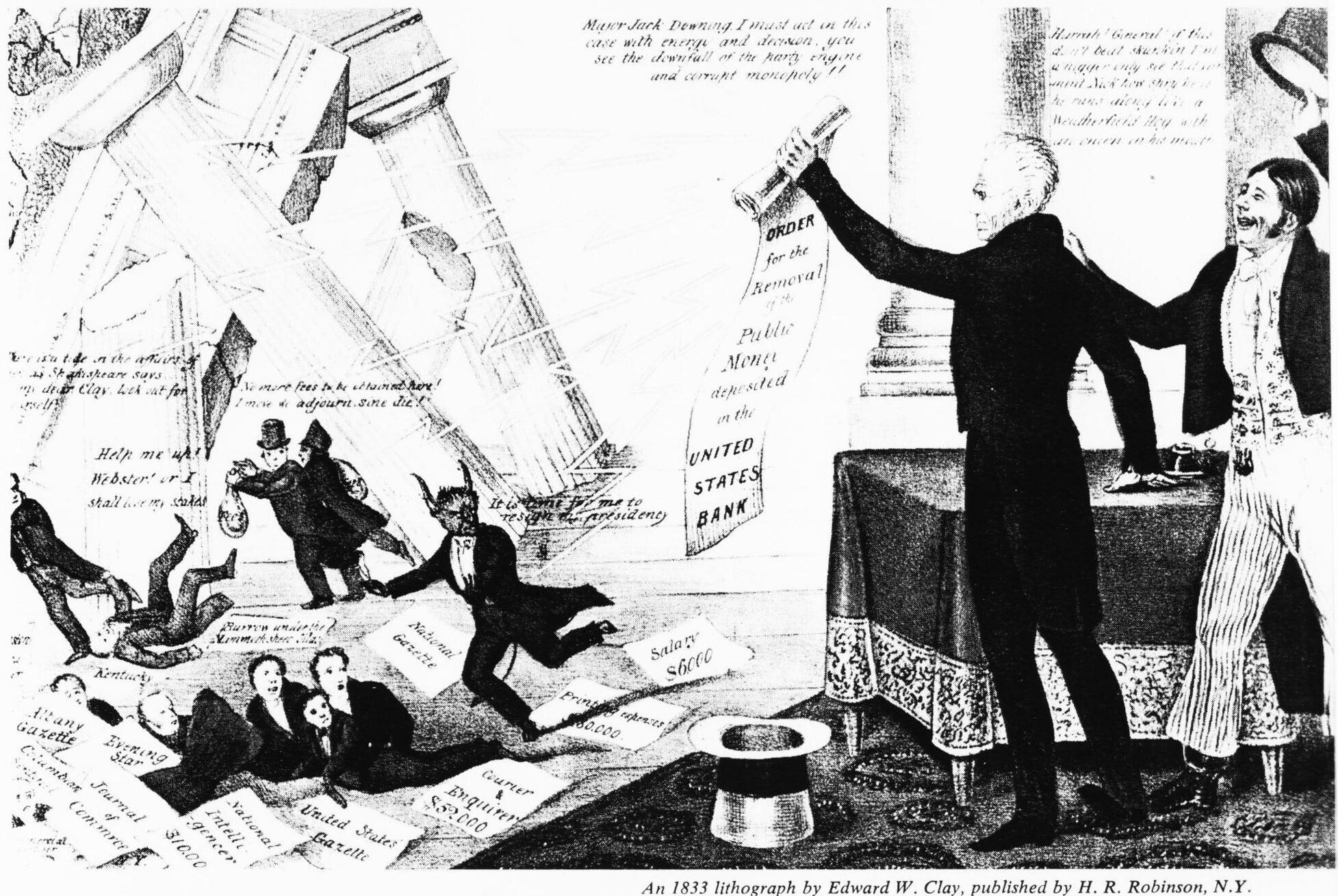

| Jackson Destroys the Banks A Satanic Banker Runs Away |

That mode of banking lasted until around the "civil war". The common narrative about the United States Civil War is that it was a struggle about slavery, or about two regions with divergent cultural histories--the industrial north and the agricultural south. But another interpretation is it was another theater of "great game" politics and an attempt by the British to weaken and break up the United States to maintain their empire and to re-establish a US central-bank branch of the Bank of England.

During the time of the civil war the Union was in a strongly antagonistic relationship with Britain and France, but found common cause with Germany and Russia. In fact, the Russians, under Czar Alexander II, offered military aid at a crucial moment in the war and kept the British and French from providing aid to the confederacy.

During the time of the civil war the Union was in a strongly antagonistic relationship with Britain and France, but found common cause with Germany and Russia. In fact, the Russians, under Czar Alexander II, offered military aid at a crucial moment in the war and kept the British and French from providing aid to the confederacy.The victorious north also had a victorious financial system. The constitution gives power to the congress to issue money, and Lincoln did that with the "Greenback". The Greenback is a very dangerous idea for the bankers all around the world--it's as dangerous as the Pythagoreans thought sqrt(2) is. If people realized all wealth comes from them, and that there's actually nothing in the bank, and in fact the financial sector is, at best, a parasite, and typically more like a predator, the con would be over.

During the civil war the Union found herself on the same side as the Russian Empire, and not so coincidentally on the same side financially. However, in the decades after the civil war, Wall Street helped finance the budding Empire of Japan, and encourage them in war against Russia, and also financed the communist revolution, and toppled the Tsar. These are really the key decades in American history--when any shred of the ideas and ideals of the founding disappeared. The assassination of Lincoln, then William McKinley brought in the counterrevolutionaries and turned the United States into something more British.

This really kooky condition continues today. The friction between "The United States" and Russia is essentially this same issue. Putin booted "western" companies from Russia's oil sector and jailed the operatives of the "western" financial sector. (At least that's how I interpret those events currently) Russia's not a total financial basket case like the Western countries.

So from that perspective, Putin and Lincoln, perhaps would have been brothers in arms, while the current set of rodentates in Washington/New York are aligned with the City of London.

Saturday, December 7, 2013

Bitcoin Value

The siren song of current affairs is distracting me from the historical research. I want to take a stab at figuring out how to value bitcoin.

Bitcoin is two things, a protocol, and a network consisting of lots and lots of hardware. The "coins" are really units of computer work that's necessary for the protocol to function. Bitcoin could replace large swaths of the banking system--really the electronic accounting systems and payment transfer systems. Wire transfers, ACH transactions, credit card transactions, pay pal transactions, all these things can be replaced with a cheaper system--a theoretically cheaper system.

Is it a better system? One of the problems with bitcoin is that transactions take about an hour to settle. Order a cup of coffee--wait an hour, get your coffee? This is a very unfortunate aspect of the current version of the protocol. Bitcoin probably isn't viable unless that's cut to seconds--perhaps that's feasible.

Is it cheaper? Well, cheaper than what? Bitcoin is really designed to obviate a trusted third party for settlement. With the current protocol, it takes many thousands of computers cranking away 24/7 to accomplish this. That's expensive. Compare that to the potentially low cost of a trusted third party hosting a webservice for payment settlement--a couple servers can handle millions of transactions at very low cost. Also, there are many middlemen involved to make the system work--paradoxically they are charging a lot more than a bank or brokerage might for various services.

I think aspects of the bitcoin system are totally ingenious and valuable--like the public ledger idea. However, the inefficiency of the network processing transactions is a big weakness.

Right now, the bulk of the bitcoin price is based on speculation. I'd say the speculation is really about whether the protocol can be improved; if a transaction time can be dropped to seconds, then bitcoin will go into wider use. Even then, it will be hard for bitcoin to beat a trusted third party service.

I think aspects of the bitcoin system are totally ingenious and valuable--like the public ledger idea. However, the inefficiency of the network processing transactions is a big weakness.

Right now, the bulk of the bitcoin price is based on speculation. I'd say the speculation is really about whether the protocol can be improved; if a transaction time can be dropped to seconds, then bitcoin will go into wider use. Even then, it will be hard for bitcoin to beat a trusted third party service.

Subscribe to:

Posts (Atom)